Weekly Significant Activity Report - October 11, 2025

Energy becomes the center of gravity in the Russia-Ukraine war, China unveils sweeping new restrictions on rare earth metal exports, North Korea celebrates the 80th anniversary of its ruling party.

This week’s analysis highlights some of the most significant geopolitical developments involving America’s adversaries between October 4 - 11, 2025.

Summary:

A range of events this week, from Ukrainian strikes on Russian oil refineries and Russian strikes on Ukrainian energy infrastructure to new international deals contesting Russia’s oil and gas exports, suggest that energy has emerged as the new center of gravity in the war.

China imposed sweeping new export controls on critical minerals targeting US technology companies. Beijing may have intended this as a reciprocal response to US technology restrictions, but the Trump administration is likely to view it as an intensely hostile act that derails trade negotiations and triggers severe retaliation. While Beijing is likely prepared to handle a short and sharp escalation in a trade war with the US over critical minerals, it may ultimately be at a structural disadvantage if the US is willing to endure a prolonged standoff.

North Korea celebrated the 80th anniversary of the founding of the Workers’ Party of Korea. The celebration featured new additions to North Korea’s nuclear arsenal as well as robust international support for the Kim regime.

1. ENERGY BECOMING THE CRITICAL BATTLEGROUND IN THE WAR BETWEEN RUSSIA AND UKRAINE

Russia Offers Deep Discounts for Crude Oil to Indian Refiners

An October 8 Bloomberg report suggests that Russia is trying to shore up its oil trade with India by offering deals that are too good to pass up. The discount Russia has provided for its crude oil to Indian buyers has more than doubled from -$1/barrel to as much as -$2.5/barrel to entice Indian buyers.

Washington and Moscow Both Squeeze Serbia Over Dependence on Russian Energy

This week, the US imposed sanctions on Serbia for failing to nationalize its NIS (Oil Industry of Serbia) oil company. The move comes after years of mounting Western pressure on Serbia to take control of NIS from Russian fossil fuel giant Gazprom who owns 45% of the company and is part of an intensifying US campaign to squeeze Russia’s energy sector.

Russia has repaid Serbia’s loyalty by offering Belgrade only a short-term gas deal through the end of 2025, rather than the long-term assurances that would help mitigate the impact of US sanctions.

The European Union and Turkey Preparing to Cut Energy Trade with Russia

This week Reuters reported that the European Union has proposed a plan to completely eliminate its remaining energy trade with Russia by January 2028. Reuters also reported that Turkey, under pressure from the US, is preparing to decrease its imports of natural gas from Russia and Iran through a combination of imports of liquid natural gas from the US through a 20-year contract with Mercuria, and increasing domestic production through its state-owned Turkish Petroleum Corporation (TPAO).

Russia Has Disabled More than Half of Ukraine’s Natural Gas Infrastructure

Reporting this week by several sources suggests that Russian strikes in recent weeks have damaged or disabled 60% of Ukraine’s natural gas production. The most significant damage took place between October 3 and October 10.

October 3 - Russian forces struck Ukraine’s Naftogaz sites in Kharkiv and Poltava oblasts with 35 missiles and 60 drones.

October 10 - Russia launched what Ukrainian Prime Minister Yulia Svyrydenko described as “one of the largest concentrated strikes” on Ukraine’s energy infrastructure. The strikes caused blackouts throughout Kyiv and Odesa.

Gasoline Shortages Widespread Across Russia

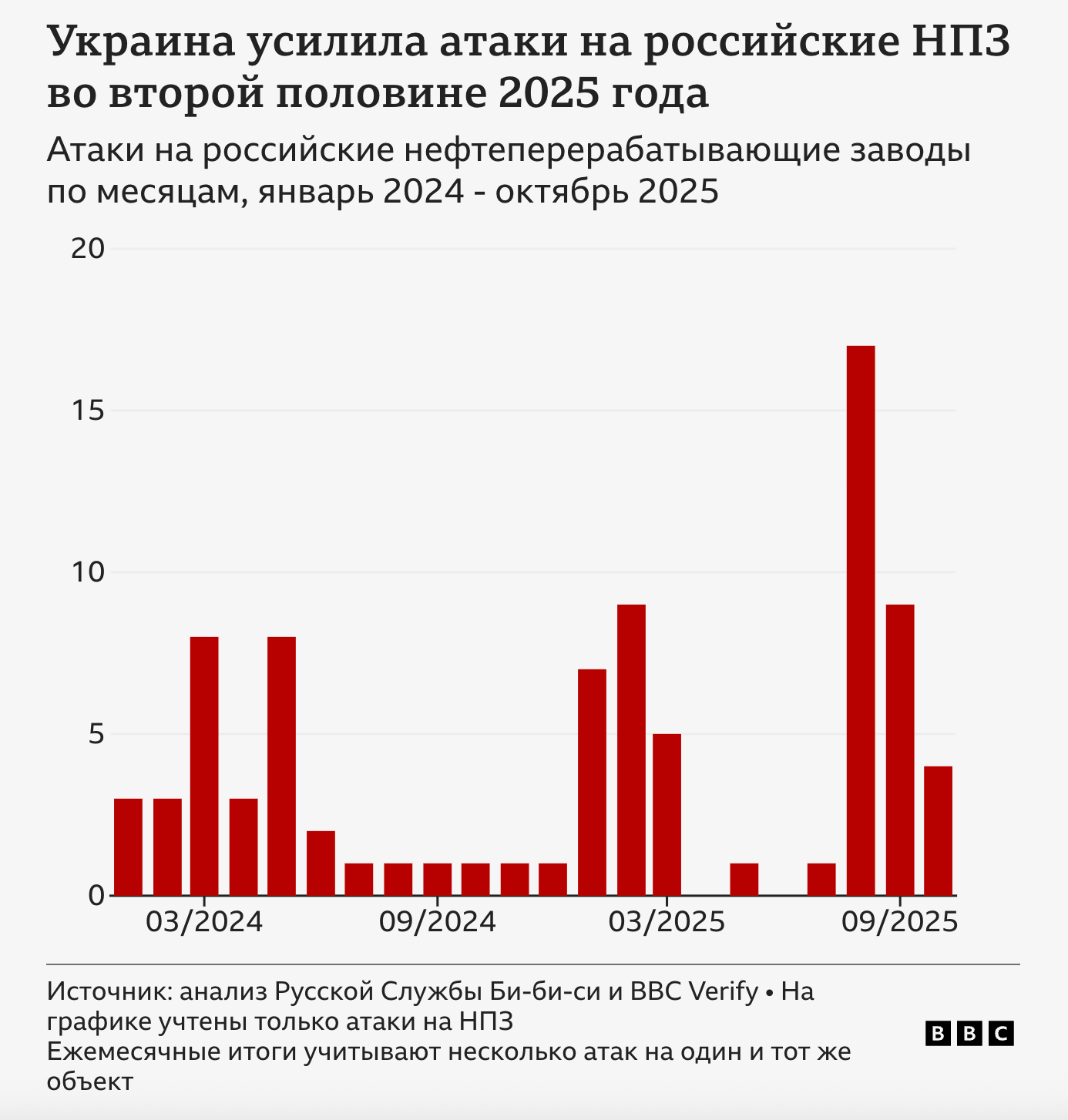

On October 11, the BBC Russian Service reported that as many as 57 of Russia’s 89 regions are experiencing shortages of gasoline. The shortages vary in intensity, and have caused the price of fuel to spike across the country as Russia now has been forced to import gasoline from foreign producers. The shortages are the result of an intensifying Ukraine campaign of long-range drone and missile strikes which has damaged 21 of Russia’s 38 major refineries since the start of the year.

Takeaways:

On Russian Strikes on Ukraine’s Energy Grid:

The latest Russian strikes represent the start of the Kremlin’s annual campaign to destroy Ukrainian energy infrastructure ahead of winter. The strikes over the past week plus have been especially damaging which suggests that Russian drones and missiles had greater success evading Ukrainian air defenses.

Ukrainian President Volodymyr Zelensky has cited poor weather on October 10 as an explanation for reduced air defense intercept rates. However, as noted in OPFOR Journal’s July 10 Situation Report: Russia’s 2025 Shahed Drone Offensive, Russia has made substantial technical upgrades to its long-range strike drones over the past year along with overall improvements in targeting, which has collectively improved its ability to overcome Ukraine’s air defenses. Reporting by the Financial Times on October 1 also suggests that Russia has made significant modifications to its ballistic missiles as well which has made their flight paths more unpredictable and difficult to intercept.

Ukraine has historically adapted quickly to periods of Russian technical advantage, particularly in the ongoing arms race over drones and missiles, suggesting the effectiveness of Russian strikes may peak and decline.

On Russian Energy Exports:

The Trump administration’s relationship with the Ukrainian government has oscillated between public hostility and more recent displays of solidarity and even encouragement. Whether this apparent shift toward Ukraine will endure remains uncertain. However, increasingly frequent consultations between US and Ukrainian officials in recent months—coinciding with Ukrainian strikes on Russian energy facilities and President Trump’s denunciations of countries purchasing Russian oil—suggest a coordinated effort to compel Russian President Vladimir Putin to end the war by squeezing the Russian economy through its oil and gas sector.

Widespread Russian gas shortages and the proposed 2028 deadline for the EU and Turkey to diversify away from Russian energy imports represent significant progress toward this goal. However, sustained and increasing pressure is needed to truly cripple Russia’s economy. The deeper discounts on oil reportedly being offered to India and the resort to importing gasoline from abroad show that Putin will continue to pursue stopgap measures to fund the war, even as long-term economic indicators worsen.

On Serbia:

Russia’s refusal to commit to a long-term energy agreement leaves Serbian President Aleksandar Vučić in an increasingly dire political situation. Student-led protests against corruption have spread across the country over the past year and become a potent challenge to Vučić’s rule. Vučić’s predicament is set to worsen as US-imposed sanctions and Russian-imposed energy uncertainty cloud Serbia’s economic outlook.

Russia’s treatment of Serbia, which has remained its friend despite pressure from the EU, may seem self-defeating but the Kremlin likely sees Vučić as less loyal than his critics in the West believe. Serbia under Vučić has balanced its ties with Russia, its historic ally, with its relations with the EU. This has resulted in significant Serbian military support provided to Ukraine through the EU, including nearly a billion dollars in artillery munitions. The Kremlin, which had tolerated Serbia’s support of Ukraine until it began leveling formal denunciations at Belgrade earlier this year, may be increasing pressure on Serbia now to force Vučić to take a more pro-Russian stance.

The Kremlin may also assume that any successor to Vučić is likely to be more overtly pro-Russian and therefore can risk seeing the current government collapse. One possible successor is former Deputy Prime Minister Aleksandar Vulin, who was expelled from the Serbian government at the urging of the EU due to his close ties to the Kremlin. Vulin, who currently runs the Serbian-Russian Historical Society (a branch of the Russian Historical Society led by Sergey Naryshkin, head of Russia’s Foreign Intelligence Service (SVR)) suggested that Russian intelligence services played a key role in suppressing anti-government protests in the spring before his removal from government. The endurance of ongoing student protests, which have outlasted Vulin, indicates that this assumption may prove to be another strategic miscalculation by the Kremlin.

2. US-CHINA TRADE WAR DRAMATICALLY ESCALATES

China Imposes Sweeping New Export Controls on Critical Minerals

On October 9, the Ministry of Commerce of the People’s Republic of China released eight new directives imposing new export controls on critical minerals.

Announcement 55 - Restrictions on the export of super-hard materials

Concerns the export of materials for the creation of synthetic diamonds less than 50 nanometers in size and manufactured products involving synthetic diamonds. The synthetic diamonds in question are used as parts of precision machine tools, such as 45 nanometers or smaller diamond wire saws and diamond tooth grinders.

Announcement 56 - Restrictions on the export of rare earth production and processing equipment

Concerns the export of furnaces, centrifuges, mills, diffusers, grinders, magnets and other specialized machines used to produce and process rare earth minerals through the Czochralski process.1

Announcement 57 - Restrictions on the export of rare earth minerals used to produce industrial magnets

Concerns the export of materials and alloys of holmium, erbium, thulium, europium and ytterbium. These minerals are used to produce powerful magnets used in advanced technological applications such as medical lasers, fiber optic communications, quantum computing, and nuclear reactors.

Announcement 58 - Restrictions on the export of advanced lithium batteries and battery making equipment

Concerns the export of high density solid state batteries with an energy density greater than or equal to 300 Watt hours/kg, as well as the specialized equipment needed to produce such batteries.

Announcement 59 - Unclear

Announcement 60 - Unclear

Announcement 61 - Restrictions on the export of rare earths used for military technology and the production of advanced semiconductors

Concerns the export of rare earth minerals to entities whose operations endanger China’s national security. Specifically targets defense suppliers and technology companies:

“2. In principle, export applications to overseas military users, as well as export applications to importers and end-users listed on the export control list and watch list (including their subsidiaries, branches and other branches in which they hold a 50% or more stake) will not be approved.

“3. In principle, export applications for products that are or may be used for the following end uses will not be approved:

“(1) Designing, developing, producing, and using weapons of mass destruction and their means of delivery;

“(2) terrorist purposes;

“(3) Military use or enhancement of military potential.

“4. Export applications for the ultimate purpose of research and development, and production of 14-nanometer and below logic chips or 256-layer and above memory chips, as well as production equipment, testing equipment and materials for manufacturing the above-mentioned process semiconductors, or research and development of artificial intelligence with potential military applications will be approved on a case-by-case basis.”

Announcement 62 - Restrictions on the export of technology used to extract and refine rare earth minerals

Concerns the export of technology, equipment, and know-how needed to extract and refine rare earth minerals.

China Imposes Special Port Fees for US Ships

On October 10, China’s Ministry of Transport announced that it will begin charging special fees for US ships docking in Chinese ports on October 14.

“Ships subject to the special port fees also include those owned or operated by entities where U.S. enterprises, organizations and individuals hold a direct or indirect stake of 25 percent or more, as well as all the U.S.-flagged and U.S.-built vessels, the ministry said.

The transport ministry outlined a phased escalation for the special port fees on eligible U.S. vessels berthing at Chinese ports, which will initially be 400 yuan (about 56.3 U.S. dollars) per net tonne from Oct. 14 and increase annually on April 17 for the subsequent three years.” - Xinhua, October 10

Takeaways:

On the Impact of Chinese Export Controls

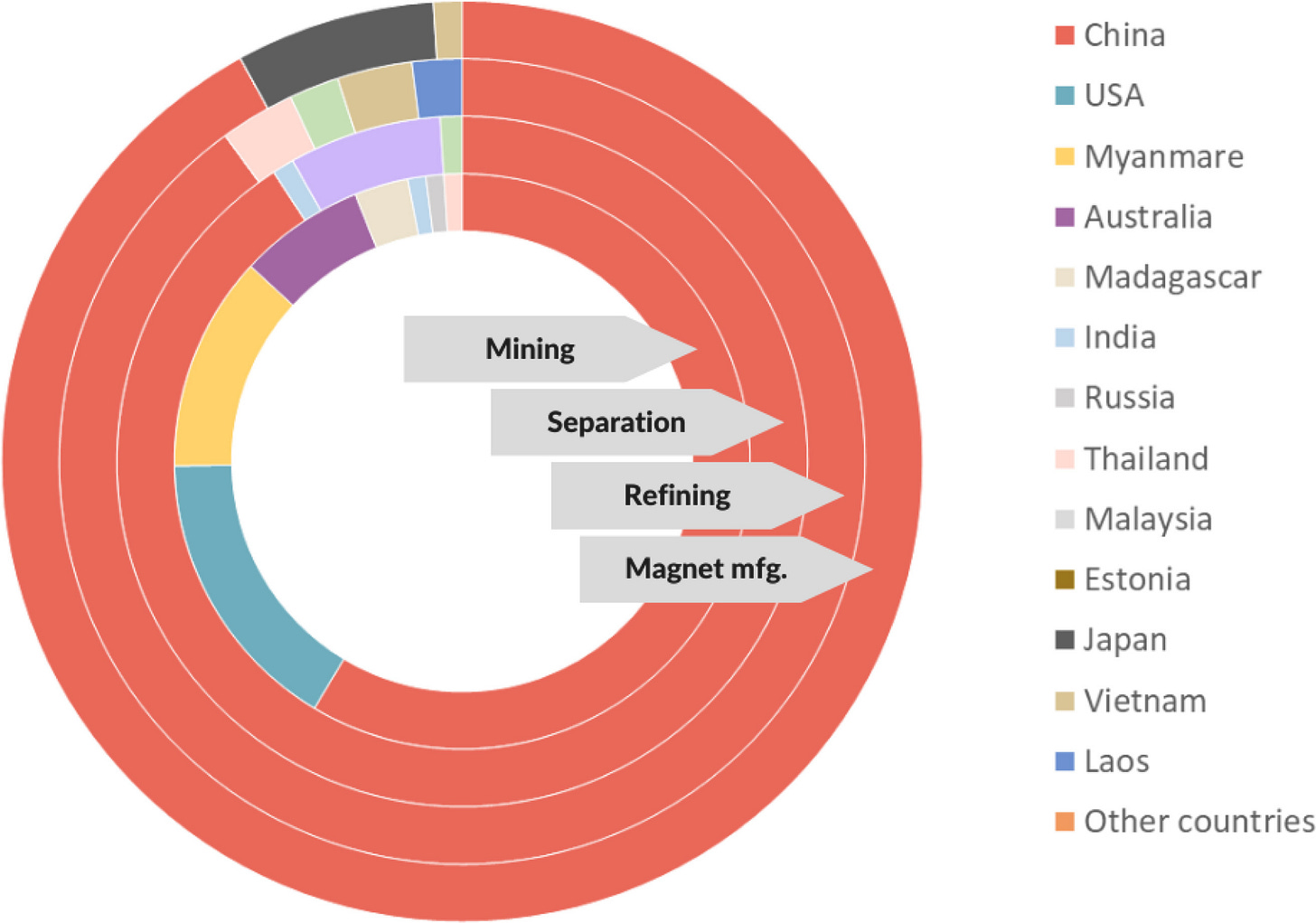

China’s sweeping restrictions on exports of critical minerals essential for the production of advanced technologies could significantly impact not only the US but the global economy more broadly. China dominates much of the global supply chain for rare earth metals and other critical minerals. Its dominance extends not only from extracting the minerals but in refining them into alloys usable as components for high technology products.

Overview of China’s dominance in making rare earth permanent magnets, key components in green energy, and other advanced technologies. Source: Depraiter, Lisa, Stéphane Goutte, and Thomas Porcher. “Geopolitical Risk and the Global Supply of Rare Earth Permanent Magnets: Insights from China’s Export Trends.” Energy Economics 146 (May 2025): 108496. https://doi.org/10.1016/j.eneco.2025.108496. The new restrictions on magnetic rare earth minerals holmium, erbium, thulium, europium and ytterbium as well as high density lithium batteries add to export controls China has imposed on other critical minerals since late 2024.

The immediate impact of these restrictions remains uncertain as the controls go into effect on November 8. The total number of licenses China will issue for exports and to whom is still unclear. Global supply chains will take time to reveal chokepoints, as many companies and countries have stockpiled critical minerals to cope with potential disruptions. When impacts do materialize, they will be felt most acutely in the defense, technology, clean energy and automotive industries.

This round of restrictions appears specifically targeted at Western chip makers and AI companies, with China explicitly tightening exports of rare earths used in advanced semiconductor production. The export controls represent the latest in a series of tit-for-tat moves aimed at compelling the US to ease restrictions on Chinese access to advanced semiconductors while simultaneously cultivating domestic alternatives. These restrictions could threaten to bust the massive AI investment boom in the US by constraining the inputs the tech industry needs to scale their AI operations. China’s export controls could impede access to both the raw materials required for advanced semiconductor production and the components needed for nuclear, other renewable energy systems that the tech industry and investors are pursuing to power AI infrastructure.

On the Wisdom of Chinese Export Controls

As several prominent analysts have noted, China’s export controls closely mirror restrictions the US has imposed on the exports of advanced technology to China on national security grounds. In this sense China’s export controls may be a reciprocal move made to signal to the US that China will escalate to match any US pressure in the hopes of eventually brokering a mutual deescalation in the trade war. If this is Beijing’s intent, however, there is a high probability the US will misinterpret the signal.

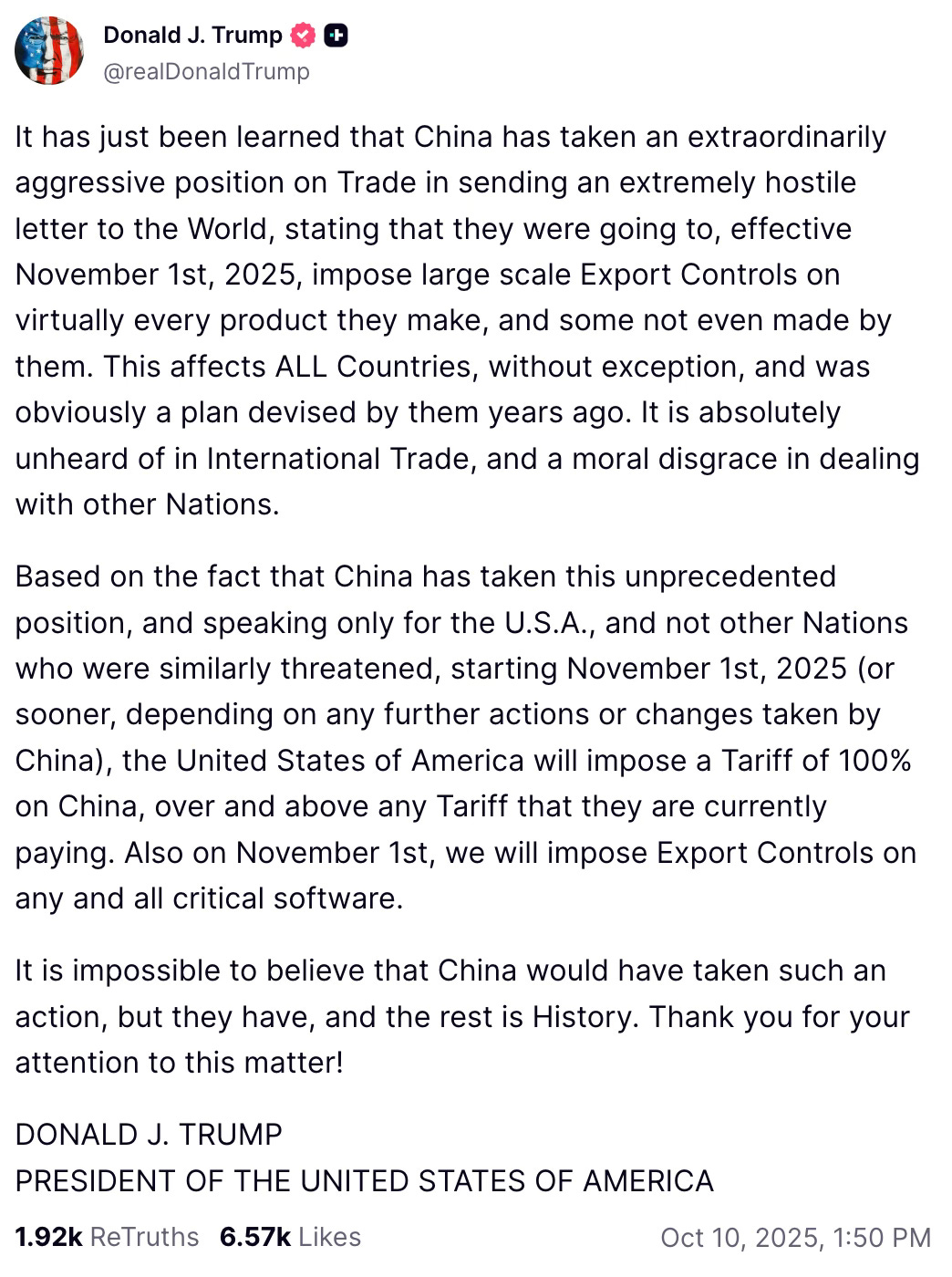

Statements by US President Donald Trump in the wake of the export controls frame the move as a deliberate and long-prepared attack on US global leadership.

President Trump reacting to China’s export controls on Truth Social on October 10, 2025. Source: @realDonaldTrump on Truth Social. While President Trump regularly makes exaggerated and misleading claims, there is good reason to believe he feels blindsided and possibly betrayed by this move. Trump has spent weeks touting substantial progress in trade negotiations with China, including a tentative deal for the sale of TikTok to US investors and offers to ease restrictions on Nvidia’s most advanced chips for Chinese buyers. Given his tendency to personalize political developments, Trump may perceive the escalation as designed to undermine him amid mounting domestic political crises and to distract from his attempts to broker a Middle East peace agreement. The subsequent move to charge special fees on US shipping will add to the President’s feelings of unfair treatment.

Trump’s threats to dramatically escalate US tariffs and impose export restrictions on “all critical software”—likely referring to Nvidia’s Compute Unified Device Architecture (CUDA) programming ecosystem—along with his suggestion that he would skip a planned meeting with Xi Jinping at next week’s Asia-Pacific Economic Cooperation (APEC) summit in South Korea, suggest this misunderstanding could trigger a damaging escalation spiral.

While China currently has a dominant position in extracting and refining critical minerals, this does not necessarily mean China has a dominant overall position in a trade war stemming from critical minerals. Beijing cannot just end the exports of critical minerals without substantial difficulties and trade offs involved. China’s export driven economy depends on the export of materials derived from critical minerals, sometimes at varying stages of development. However much Beijing wishes for technological self reliance, its continued technological development still depends on advanced Western products and services, including Western semiconductors and operating systems. As noted in last week’s Significant Activity Report, Huawei and other Chinese tech giants may be inflating or even faking progress toward domestic production of advanced semiconductors in response to pressure from CCP leaders, while still relying on Western chips.

China’s position in this trade relationship may even be more vulnerable than the US in a prolonged trade conflict. China controls the low end of the value chain in critical minerals, while the US controls the high end in value added technology. While US technology products have become dependent on Chinese raw materials, the materials are still commodities that can be sourced from alternative suppliers from around the world.

It will be exceptionally difficult for China to prevent transshipments of critical minerals through secondary markets to US buyers. US tech companies could leverage their immense private capital and government backing to make irresistible offers to entities that China does grant export licenses. Beijing should be especially familiar with this dynamic given its own role in facilitating Russian oil exports amid Western sanctions.

China by contrast faces a fundamentally more complex challenge in developing an entirely domestic technology stack. This is an open ended and continuously evolving problem set that is less easily solved by money and policy alone. A protracted trade war over critical minerals is therefore more likely to accelerate US and allied efforts to reduce dependency on Chinese supplies than to result in China achieving complete technological self-reliance.

3. NORTH KOREA CELEBRATES THE 80 YEAR ANNIVERSARY OF THE KIM REGIME

Kim Jong-un Welcomes Foreign Leaders for Celebrations

This week, North Korea celebrated the 80th anniversary of its ruling Workers’ Party of Korea, founded by Kim Jong-un’s grandfather Kim Il-sung. Several world leaders attended the week’s events including the Laotian President Thongloun Sisoulith, General Secretary of the Communist Party of Vietnam To Lam, Former Russian President and current Deputy Secretary of the Russian National Security Council Dmitri Medvedev, and Chinese Premier Li Qiang.

North Korea Unveils New Missile System

At the military parade culminating the anniversary on October 10, the North Korean military unveiled its next generation Hwasong-20 Intercontinental Ballistic Missile System (ICBM).

Takeaways:

The seminal event provided Kim an opportunity to connect his leadership with the legacy of that of his father and grandfather. Kim’s speech celebrating the anniversary connected his decision to support Russia’s war against Ukraine with the anti-imperialist beginnings of the Democratic People’s Republic under Kim Il-sung. The unveiling of the new Hwasong-20 ICBM represents the culmination of North Korea’s drive for a nuclear deterrent to safeguard its sovereignty—a policy accelerated by Kim’s father, Kim Jong-il, following the collapse of the Soviet Union. The presence of so many foreign leaders has given Kim an opportunity to distinguish himself as a transformative leader who has not only helped the country survive but become self-confident, internationally respected, and militarily sophisticated.

The dramatic unveiling of the new Hwasong-20 ICBM was likely designed to cement North Korea’s status as a true global nuclear power. The missile, previously discussed in detail in the Weekly Significant Activity Report - September 13, 2025, has the potential to dramatically reshape the strategic balance on the Korean peninsula by putting the entire continental US in the range of faster launching and more heavily armed nuclear weapons. These claims remain theoretical as the missile itself has not yet been tested.2

The display may nevertheless serve to emphasize to the US that the previous policy of denuclearization has definitively failed, and that even China and Russia, whose top-ranking officials attended the unveiling, have accepted the country as a nuclear power. North Korea has repeatedly signaled to the US in recent weeks that it is open to renewed dialogue under the condition that its status as a nuclear power is recognized.

The Czochralski process is a means of growing high-purity crystals of various minerals, and is necessary for producing modern advanced semiconductors.